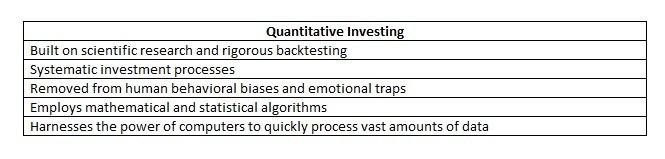

Many areas of modern life rely on scientific research and are guided systematically by well-defined rules. When designing self-driving cars or developing surgical robots, fields such as physics, math, statistics, and computer science are all relied upon. Finance and investing are no different. Finding ways to maximize gains while minimizing downside risks is the goal of investment analysis and portfolio management. There are various schools of thought on how to achieve this, but two popular examples are 1.) traditional fundamental analysis and 2.) a more quantitative approach. The former is the classic way to examine company financials and evaluate investments. Quantitative investing, on the other hand, is based on identifying reasonable, repeatable, and measurable hypotheses regarding behaviors of financial instruments and markets. It has advanced to a highly specialized discipline, which has offered quantitative investors additional tools and insights as well as speed thanks largely to a series of developments:

Computational power has roughly doubled every two years since the 1970s

Computational power has roughly doubled every two years since the 1970s

There has been an exponential increase in data availability accompanied by a decrease in storage costs due mostly to cloud computing

There has been an exponential increase in data availability accompanied by a decrease in storage costs due mostly to cloud computing

Powerful new algorithms in AI (“Artificial Intelligence”) and its subset of machine learning have been developed from more traditional techniques in fields such as computer science and statistics

Powerful new algorithms in AI (“Artificial Intelligence”) and its subset of machine learning have been developed from more traditional techniques in fields such as computer science and statistics