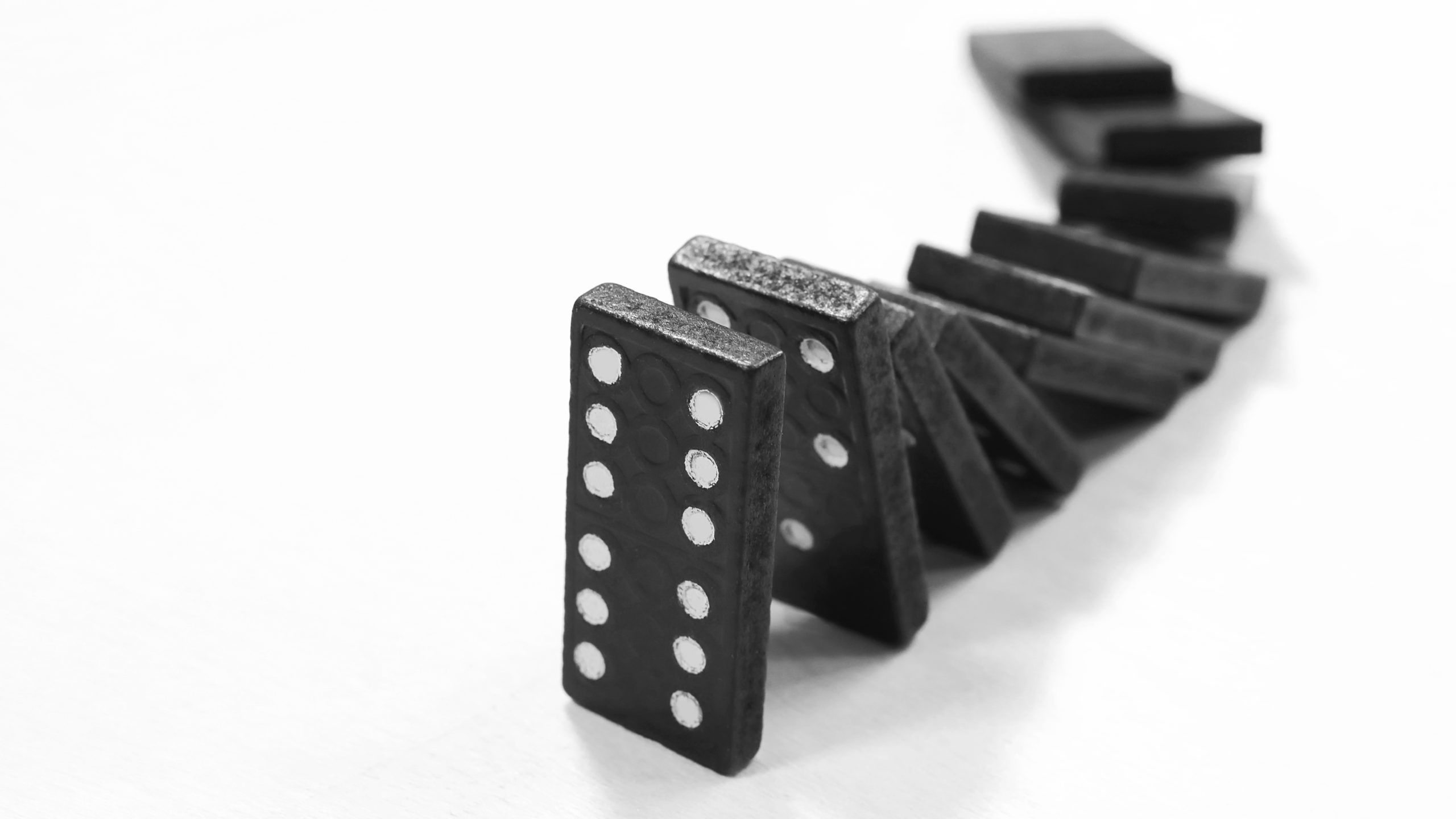

Effective risk management is essential to successful investing. There are numerous sources of risk that can affect stocks, bonds, and other financial assets. One of the most dangerous is systemic risk. This involves a domino effect in which one sector, or even company, becomes a hazard to the entire financial system and global economy. The best example is the 2008 financial crisis in which the housing bubble burst and large banks holding low-quality mortgage debt suffered huge losses. This was the catalyst for tightening credit spreads, plummeting stock markets, soaring unemployment rates, a global recession, and severely damaged confidence in the financial system. Still, there were a few astute investors who were able to predict the blowup in mortgage-backed securities by analyzing the housing industry and the quality of loans, or lack thereof, at the height of the bubble. However, it is much harder to predict systemic risk when it comes from one, single source.

Ten years before the financial crisis, the saga of Long-Term Capital Management (LTCM) would serve as a dire preview. The $126 billion dollar hedge fund nearly collapsed in 1998 as a result of risky investments funded by excessive borrowing, and due to LTCM’s “too big to fail” stature, the Federal Reserve had to intervene and broker an arrangement for a group of banks to bail out the fund. Luckily, the Fed’s intervention helped to limit the domino effect that would have ensued had LTCM been allowed to fail.

In March of this year, a single investment firm again sparked chaos with risky investments funded by excessive borrowing. Archegos Capital Management, a multibillion-dollar family office, had built considerable leveraged positions in large media companies, such as ViacomCBS, before unpopular news came out that caused these stock prices to decline precipitously. The large losses suffered by Archegos triggered a margin call, which forces a borrower to inject more capital or sell borrowed securities. Eventually, the firm’s lenders seized the securities and began selling them en masse throwing the underlying companies’ share prices into further collapse. Despite regulators’ best efforts, potential systemic risk is ever present and can come seemingly out of nowhere.

Systemic risk often stems from the failure of risk management at an institutional level, but that does not mean that risk management cannot be used to effectively protect your portfolio from times of crisis. Portfolio and risk managers often employ a variety of hedging techniques and risk control actions that include position sizing, stress testing, running Monte Carlo simulations, and monitoring risk metrics on an ongoing basis. Additionally, managers that follow a strict process and have rules in place to limit irrational decision-making in times of deep market stress may have a better probability of controlling downside risk.

Disclaimer

The views expressed represent the opinion of Passage Global Capital Management, LLC. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute as investment advice and is not intended as an endorsement of any specific investment. Employees and clients of Passage Global Capital Management may own securities discussed in this article. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Passage Global Capital Management, LLC believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections and other forward-looking statements are based on available information and Passage Global Capital Management, LLC’s views as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumption that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements.