Of the specialized investment strategies popular across the board today, factor investing is one of the most interesting. Popular with both quantitative investors and those with a more traditional approach to money management, factor investing is a discipline heavily focused on research. With its roots in the investors of the 1970s, factor investing seeks to identify distinct factors that drive stock returns.

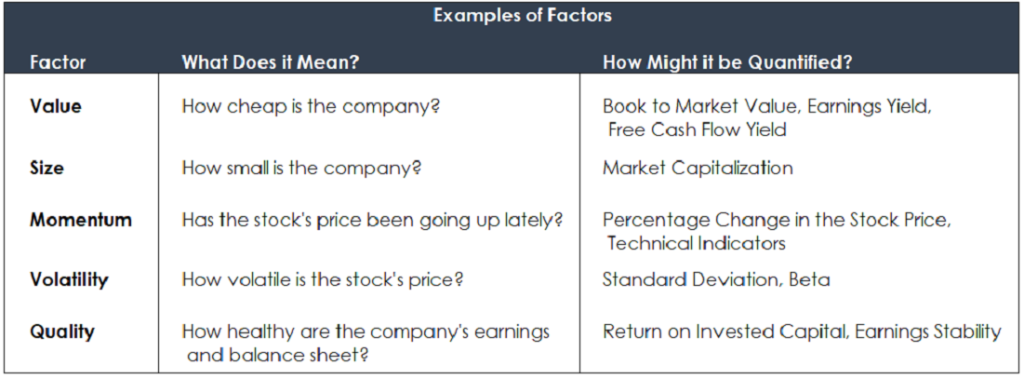

By quantifying and identifying these factors and their presence in other instruments, an investor can theoretically make smart strategic decisions to grow their assets. What are some of the things investors look for that hint at future success?

Understanding the “Factors” in Factor Investing

The popularity of factor investing can be credited to Eugene Fama and Kenneth French, creators of the Fama-French Three Factor Model. This model identified three factors that drove stock returns:

Market Risk

Market Risk

Size: Smaller-cap stocks tended to outperform larger ones

Size: Smaller-cap stocks tended to outperform larger ones

Value: Cheap stocks, as measured with the book to market ratio, tended to outperform expensive ones

Value: Cheap stocks, as measured with the book to market ratio, tended to outperform expensive ones

Other factors that have been added to the model over the years include liquidity, quality, and momentum. Ultimately, the investments that perform well are typically those in which you can identify the presence of multiple favorable factors.

What Risks Does a Factor-Based Approach Entail?  Every strategy involves some level of risk, and choosing investments based on market factors is no different. First, it is not possible to fully assess all the factors that drive returns. Second, market volatility or a sudden downswing may bring new factors into play. Just as there are attributes that may make your investments smart choices, there are also some that can negatively impact your investments in the same degree. When market conditions change rapidly, what made your selections successful could work against them instead.

Every strategy involves some level of risk, and choosing investments based on market factors is no different. First, it is not possible to fully assess all the factors that drive returns. Second, market volatility or a sudden downswing may bring new factors into play. Just as there are attributes that may make your investments smart choices, there are also some that can negatively impact your investments in the same degree. When market conditions change rapidly, what made your selections successful could work against them instead.

Incorporating Advanced Strategies into Your Investment Portfolio

With a substantial volume of trades on the market every day and new businesses entering the arena all the time, identifying the factors outlined above often proves challenging. Separating the signal from the noise can require an immense amount of research and continual re-evaluation of your assumptions about the business. There is thankfully a better way to tackle this problem.

At Passage Global Capital Management, we believe that the underlying principles of factor investing can be a vital contributor to a sound strategy. We rely on quantitative investment methods powered by our rich insights into the market and unique algorithmic models. By peering into the data with the power of modern technology, we work together with our clients to produce results that align with your investment goals. Contact us today for further details.

The views expressed represent the opinion of Passage Global Capital Management, LLC. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute as investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and nonproprietary sources that have not been independently verified for accuracy or completeness. While Passage Global Capital Management, LLC believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and Passage Global Capital Management, LLC’s views as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumption that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements.